When Is a Good Time to Refinance Your Home?

This article was last updated October 29, 2025.

You may have heard the news: the Federal Reserve just approved its second straight interest rate cut of the year. As a result of the first cut in September, 30-year fixed mortgage rates decreased to an average of 6.13% — the lowest we’ve seen in the past few years. Naturally, these changes have many homeowners wondering whether it might be the right time to refinance — and it could be, but you’ll want to do some math first.

Most finance experts advise you to lock in a rate that’s at least 0.5% lower than your current rate to make a refinance worth it. But refinancing isn’t as straightforward as simply locking in a new, lower interest rate. You’re taking on a new loan, and new loans come with closing costs. Expect to pay 2 to 5 percent of the loan’s principal to refinance, with fees varying by state and lender. The general rule of thumb is you should be able to recoup closing costs within 18 months.

How to Know When to Refinance

To determine whether it’s a good idea to refinance, you’ll want to take into account all the variables of your situation. If you shorten your loan term, will you pay less interest in the long run? If you trade one 30-year mortgage for another, will you pay more interest in the long run? Can you afford the monthly payment? Can you switch from a potentially volatile variable interest rate to a fixed rate that helps you budget more effectively? Can you eliminate private mortgage insurance (PMI)? How long do you plan to stay in your home before selling? If you refinance your home before selling it shortly after, it may not be financially beneficial for you since you’ll have to deal with closing costs.

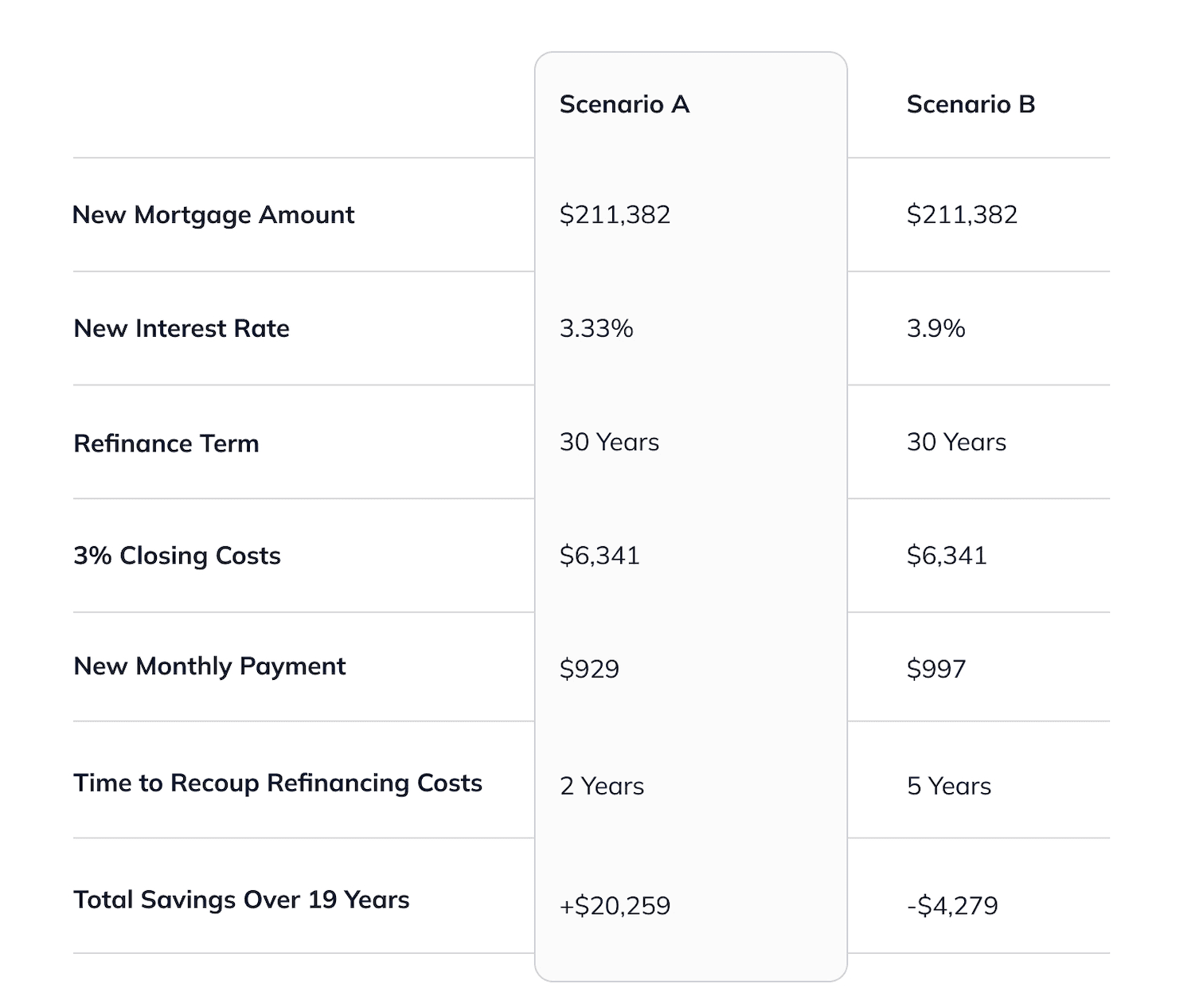

As an example, let’s say you bought a home in 2009 that’s currently valued at $300,000. Your initial 30-year mortgage was for $275,000 at a 4.25% interest rate. That leaves $211,382 left to pay off at $1,495 per month (factor in more if you’re paying PMI).

*Both examples refer to a rate and term refinance.

In scenario B, due to the length of the loan, you stand to pay more in interest. If you plan to move between years five and thirteen, you could save a few hundred dollars, but the hassle of refinancing is likely not worth the savings.

Opting for a 15-year loan over a 30-year loan in this scenario would increase your monthly payments to $1,553, but you could save nearly $12,000 over the lifetime of the loan, making it a slightly more attractive refinancing scenario. You’d recoup your refinancing costs around year three. Should You Refinance Your Home? 5 Key Areas to Evaluate

Of course, you’ll also need to look at the specific qualification requirements to determine if you meet the criteria for a refinance. While they vary by lender, these generally include a minimum credit score of 620, a 50% debt-to-income (DTI) ratio, and at least 20% equity in your home.

The SmartAsset Refinance Calculator is a great tool for homeowners to see when it may make sense to refinance their homes based on the home’s current value and mortgage.

Is a Refinance Worth It If I’m Planning to Move Soon?

Again, this depends, and you’ll want to crunch the numbers before making a decision. However, the majority of lenders charge anywhere from 2-5% of the loan’s principal for refinances. So if you’re planning a move in the short term — say, within one to two years — it might not make sense to refinance if you won’t be able to recoup those costs with the amount you’re saving by the time you put your home on the market.

Your Alternatives to Refinancing

If the refinancing math doesn’t make sense, or your credit score and loan-to-value ratio prevent you from qualifying for the best rates, you have other options.

With refinancing, you’re taking out a new loan for the remaining value that you owe on your home, ideally reducing the amount you have to pay each month, the amount of time left to pay the loan, or both.

But with a cash-out refinance, you’re taking out a new loan that’s greater than the amount you owe on your home, giving you additional cash to cover other expenses you may have, such as credit card debt or paying for an education. Cash-Out Refinance vs. Home Equity Loan: What’s the Difference?

But, if you don’t want a larger loan and potentially even larger monthly payments, you also have non-loan options. Home equity investments allow you to access cash now in exchange for a share of the future value of your home. Since it’s an investment, a home equity investment doesn’t have monthly payments.

Home equity investments may make even more sense for homeowners looking to sell within the next decade, or before they can realize any savings from a refinance. A refinance can extend the lifetime of your loan. If you had 20 years left on your mortgage, and you refinance with a 30-year mortgage, you have 10 additional years of monthly payments and interest).

The best option for you will depend on a number of factors, including your home plans, credit score, and other variables. But it also depends on your other financial goals. What do you hope to do with your savings from a refinance? Do you need cash now to achieve another financial goal, such as pay off bad debt or start a business? Do the math, weigh all your options, and determine which scenario is best for you.

Frequently-Asked Questions

At what mortgage rate does refinancing make sense?

There’s no single “magic number,” but many experts suggest refinancing when you can lower your rate by at least 0.5–1%. The right rate for you depends on your current loan terms, how long you plan to stay in your home, and whether the savings will outweigh closing costs.

How much do rates need to drop to make refinancing worth it?

A general rule of thumb: refinancing usually makes sense if you can cut your rate by at least 0.5% and expect to stay in your home long enough to recoup closing costs (typically within 18–24 months). The larger your loan balance, the less of a rate drop you’ll need to see meaningful savings.

How long will it take to break even when refinancing?

That depends on your closing costs and monthly savings. For example, if refinancing costs you $6,000 and you save $250 per month on your mortgage, your break-even point is about two years. Beyond that point, the refinance puts money back in your pocket.

Should I switch from a 30-year to 15-year mortgage with current rates?

A 15-year mortgage typically comes with a lower interest rate and much less total interest paid over time — but your monthly payments will be higher. If you can comfortably afford the larger payment and want to pay off your home faster, a 15-year refinance can be a smart move. But if flexibility in your budget is more important, sticking with a 30-year loan may make more sense.

The more you know about your home equity, the better decisions you can make about what to do with it. Do you know how much equity you have in your home? The Home Equity Dashboard makes it easy to find out.

You should know

We do our best to make sure that the information in this post is as accurate as possible as of the date it is published, but things change quickly sometimes. Hometap does not endorse or monitor any linked websites. Individual situations differ, so consult your own finance, tax or legal professional to determine what makes sense for you.